You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation

- Thread starter SlowUpTake

- Start date

More options

Who Replied?- MBTI

- ENFP

- Enneagram

- 947 sx/sp

Trump says iPhones could be made in the United States. In 2017, Tim Cook said this:

“There’s a confusion about China. And let me give you my opinion. The popular conception is that companies come to China because of low labor costs. I’m not sure what part of China they go to, but the truth is China stopped being the low labor cost country many years ago. The reason is because of the skill, the quantity of skill in one location, and the type of skill it is.

Like the products we do require really advanced tooling, and the precision that you have to have in tooling and working with the materials we do are state of the art. And the tooling skill is very deep here. You know, in the U.S. you could have a meeting of tooling engineers, and I’m not sure we could fill the room. In China, you could fill multiple football fields. It’s that vocational expertise is very deep.”

Cheers,

Ian

“There’s a confusion about China. And let me give you my opinion. The popular conception is that companies come to China because of low labor costs. I’m not sure what part of China they go to, but the truth is China stopped being the low labor cost country many years ago. The reason is because of the skill, the quantity of skill in one location, and the type of skill it is.

Like the products we do require really advanced tooling, and the precision that you have to have in tooling and working with the materials we do are state of the art. And the tooling skill is very deep here. You know, in the U.S. you could have a meeting of tooling engineers, and I’m not sure we could fill the room. In China, you could fill multiple football fields. It’s that vocational expertise is very deep.”

Cheers,

Ian

TomasM

Community Member

- MBTI

- INFJ

Didn't the stock market go up 2 or 3 thousand points? I heard someone say that it was the biggest gain in history. IDK, maybe I missed something or don't understand.

I don't believe it is a backpedaling. Like I said in another thread, I believe Trump is trying to identify who is a friend / partner of the United States. Now, I believe he has created a pause with those "allies," and is attempting to find a balance through negotiation. Obviously, I didn't know that he would create a pause, because I didn't know his strategy (like I said, nobody knows it), but it seems like a valid strategy nonetheless. When a country knows who their friends and enemies are, then they can start to align their interests with those partnerships.So, the bond market wibble-wobbles, Trump shits himself, and starts backpedaling on tariffs.

So predictable,

Ian

Other people on this forum said that it was a great time to buy and were happy about the "discounts." They were right, and I have to say it was smart of them to think in that direction.

TomasM

Community Member

- MBTI

- INFJ

These are the references to whom I was referring:

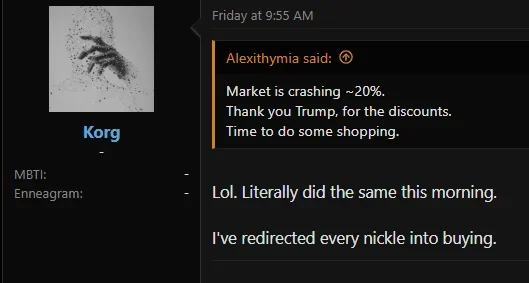

@Korg @Alexithymia

I don't say this as a way to seem ahead of the game or to ridicule those that are opposed; I'm saying it because I TRUELY believe that the INFJ, or even the high intuitive in general, has great potential. If we can harness that collectively then our future would be unbounded.

Nice posts by both Korg and Alexithymia. I'm very impressed by your foresight and actions.

@Korg @Alexithymia

I don't say this as a way to seem ahead of the game or to ridicule those that are opposed; I'm saying it because I TRUELY believe that the INFJ, or even the high intuitive in general, has great potential. If we can harness that collectively then our future would be unbounded.

Nice posts by both Korg and Alexithymia. I'm very impressed by your foresight and actions.

- MBTI

- INFJ

- Enneagram

- 954 so/sx

maybe I missed something or don't understand.

It's ok you'll survive

SlowUpTake

Permanent Fixture

- MBTI

- INFJ

- Enneagram

- ?

So my first grade brain is now fixating on the supply side of inflation. if there is not enough of the "things" that the population in general "wants" to purchase, then the price of those "things" increases. Higher prices means that the currency the population possesses has a lower purchasing power. This seems to have very little to do with the amount of currency in circulation. I am not sure if it really qualifies as "inflation" if we are agreed that inflation means inflating the amount of money in circulation.

philostam

Well-known member

- MBTI

- INTP

- Enneagram

- 6w5

So my first grade brain is now fixating on the supply side of inflation. if there is not enough of the "things" that the population in general "wants" to purchase, then the price of those "things" increases. Higher prices means that the currency the population possesses has a lower purchasing power. This seems to have very little to do with the amount of currency in circulation. I am not sure if it really qualifies as "inflation" if we are agreed that inflation means inflating the amount of money in circulation.

There's a difference between asset prices inflation and inflation of goods and services. Between 2010-2020 the inflation of goods and services was relatively low despite the fact that we "printed" a lot of money. It depends who gets this money. If the FED purchases a lot of bonds from the market (so called QE), this incentives risk taking behavior from the financial sector (buying more risky assets as opposed to safer government bonds), so we get asset price inflation (including stuff like housing).

If you print money and give stimulus directly to the people + do QE + there's is a supply crunch (Covid years), you get asset and goods and services inflation.

philostam

Well-known member

- MBTI

- INTP

- Enneagram

- 6w5

If multi millionaires get extra 200k, this will generally not lead to inflation of goods and services because their propensity to consume is low. They can already afford all the things they want. Most of that 200k will go to savings or investment.

This is kinda what QE does, it increases the amount of money slashing around in the financial system that can be invested.

This is kinda what QE does, it increases the amount of money slashing around in the financial system that can be invested.

philostam

Well-known member

- MBTI

- INTP

- Enneagram

- 6w5

These are the references to whom I was referring:

@Korg @Alexithymia

View attachment 97222

I don't say this as a way to seem ahead of the game or to ridicule those that are opposed; I'm saying it because I TRUELY believe that the INFJ, or even the high intuitive in general, has great potential. If we can harness that collectively then our future would be unbounded.

Nice posts by both Korg and Alexithymia. I'm very impressed by your foresight and actions.

We'll see about this. Investors have a Pavlovian "buy the dip" reaction that they learned over the last 40, and especially last 10 years, but if the Trump cabinet is serious about re-shoring US manufacturing and reducing US trade deficit, that's not good for US stocks. At the very least there's gonna be less foreign inflows into US assets. Foreigners own on net 20 trillion of US assets based on net international investment position which they can sell and take that money home or elsewhere.

Trump is playing a very dangerous game here, if his plan is to both tariff the shit out of everyone and at the same time wants stocks to go up.

Scott Bessent said as much the other day. He said "Wall Street had an amazing time last 40 years, and they can continue to do well, but next 4 years is more about main street".

I'm also slightly bearish Bitcoin for the first time in a long time.

Last edited:

philostam

Well-known member

- MBTI

- INTP

- Enneagram

- 6w5

Trade war is one thing, and I believe US has the upper hand.

But the flip side is capital war, where rest of the world has the leverage. They don't need to blindly shove money in to US assets anymore, and they can even sell what they have. Then what?

It's not even clear that US has the tech/AI advantage anymore.

Capital will go where it's treated the best.

But the flip side is capital war, where rest of the world has the leverage. They don't need to blindly shove money in to US assets anymore, and they can even sell what they have. Then what?

It's not even clear that US has the tech/AI advantage anymore.

Capital will go where it's treated the best.

philostam

Well-known member

- MBTI

- INTP

- Enneagram

- 6w5

I kinda think Trump is cooked already. I don't think even he has the minerals to deal with the consequences of what he started. He'll probably pivot soon and just do what Kamala/Biden would have done while talking up how we'll bring jobs back and it'll take time etc etc.

Musk on the other hand just said they can cut 250 billion of the deficit. So he went from 2 trillion to 1 trillion to 500 billion and now 250 billion in a few months lol.

Yesterday the market was up big and Trump was all happy, today we're down big and "he's not looking at the market".

It'd really surprise me at this stage if they stay the course but who knows...

Musk on the other hand just said they can cut 250 billion of the deficit. So he went from 2 trillion to 1 trillion to 500 billion and now 250 billion in a few months lol.

Yesterday the market was up big and Trump was all happy, today we're down big and "he's not looking at the market".

It'd really surprise me at this stage if they stay the course but who knows...

philostam

Well-known member

- MBTI

- INTP

- Enneagram

- 6w5

The "you voted for this" part is not really fair. Tariffs was not something that most voters cared so much and it was much bigger part of his rhetoric in 2016.

This time it was more about immigration, inflation, bringing the deficits down. Most people just assumed he'd be good for the markets as the "markets guy" and in his first term he tweeted every time the DOW made new highs.

Even on the left the stick to beat Trump with wasn't really that markets would do poorly under him.

In fact, even on this very forum I was accused of supporting Trump (even though I cannot vote) only because I was thinking about my wallet.

That was the prevailing narrative going into the election.

Last edited:

TomasM

Community Member

- MBTI

- INFJ

I think this is a very complex topic. In the short term stocks will go down and I think that money will start to move into emerging markets because the tariffs could open those markets for capital investment. But foreign companies will still want to compete in a large US market so that will induce manufacturing in the United States. To me, the smart move would be to use tariffs to gain access to natural resources in foreign markets while increasing investments into manufacturing with those natural resources.but if the Trump cabinet is serious about re-shoring US manufacturing and reducing US trade deficit, that's not good for US stocks. At the very least there's gonna be less foreign inflows into US assets.

There are policy strategies to keep capital markets prioritized on the United States but we will have to focus on one part of the strategy at a time. Right now, we know tariffs are being used to open markets and identify those who are willing to partner with the US. After those negotiations are complete, then we will see how the strategy evolves to stimulate capital markets for manufacturing growth. Wall Street won't like giving up large short term gains, but without balance in the system, everything will collapse. Right now, the choice is to back China or the US and there's a very distinct line in the sand - countries appear to trust the US more than they do China and that's why we're seeing leaders who are ready to negotiate terms and conditions.

- MBTI

- ENFP

- Enneagram

- 947 sx/sp

It’s absolutely fair. Project 2025 was explicit and clear about the use of reciprocal tariffs. It was published and available for all to see long before election day. He said what he was going to do, and then he did it.The "you voted for this" part is not really fair. Tariffs was not something that most voters cared so much and it was much bigger part of his rhetoric in 2016.

This time it was more about immigration, inflation, bringing the deficits down. Most people just assumed he'd be good for the markets as the "markets guy" and in 2016 he tweeted every time the DOW made new highs.

Even on the left the stick to beat Trump with wasn't really that markets would do poorly under him.

That voters did not read and chose to remain ignorant is on them. That they chose to remain in emotional amygdala overdrive and be swayed by the outrage nuggets is their responsibility.

Yes, they voted for this. They chose this. That they thought those below them—the brown, the poor, the disabled, the queer, women, immigrants—would be punished—is immaterial, though telling.

If we consider Trump’s record since the mid-80s (and yes, I am that old, lulz), we had every reason to be worried about the market.

He is a master of the art of the raw deal.

Cheers,

Ian

philostam

Well-known member

- MBTI

- INTP

- Enneagram

- 6w5

I think this is a very complex topic. In the short term stocks will go down and I think that money will start to move into emerging markets because the tariffs could open those markets for capital investment. But foreign companies will still want to compete in a large US market so that will induce manufacturing in the United States. To me, the smart move would be to use tariffs to gain access to natural resources in foreign markets while increasing investments into manufacturing with those natural resources.

There are policy strategies to keep capital markets prioritized on the United States but we will have to focus on one part of the strategy at a time. Right now, we know tariffs are being used to open markets and identify those who are willing to partner with the US. After those negotiations are complete, then we will see how the strategy evolves to stimulate capital markets for manufacturing growth. Wall Street won't like giving up large short term gains, but without balance in the system, everything will collapse. Right now, the choice is to back China or the US and there's a very distinct line in the sand - countries appear to trust the US more than they do China and that's why we're seeing leaders who are ready to negotiate terms and conditions.

Tariffs don't open the markets, they create more friction across the board. Yes in theory it does incentivize domestic production and manufacturing, but that's "just" taking the capital away that could've gone into stocks lol.

It's a messed up situation, in the long run I agree with you, but we live in a uber financialized world where people cannot stomach even a year or two of stock market being in a drawdown.

- MBTI

- ENFP

- Enneagram

- 947 sx/sp

The lack of infrastructure, the purge of academics, the noncompetitive matriculates of the educational system, the rabid anti-intellectualism, the aversion to critical thinking, the lack of stability in the working class, and the drain of H1B—among other things—will all be high-bar impediments to that induction.that will induce manufacturing in the United States.

Also, the majority of Americans now believe there is no benefit or reward for hard work. They have woken up to the truth that, on average, Americans end up where they begin.

That is perhaps the greatest predictor of apathy in the coming years. I’m not sure how that could be changed outside of a radical recalibration of the social order.

Cheers,

Ian

edit: mis-post double-post deleted

Last edited:

philostam

Well-known member

- MBTI

- INTP

- Enneagram

- 6w5

It’s absolutely fair. Project 2025 was explicit and clear about the use of reciprocal tariffs. It was published and available for all to see long before election day. He said what he was going to do, and then he did it.

That voters did not read and chose to remain ignorant is on them. That they chose to remain in emotional amygdala overdrive and be swayed by the outrage nuggets is their responsibility.

Yes, they voted for this. They chose this. That they thought those below them—the brown, the poor, the disabled, the queer, women, immigrants—would be punished—is immaterial, though telling.

If we consider Trump’s record since the mid-80s (and yes, I am that old, lulz), we had every reason to be worried about the market.

He is a master of the art of the raw deal.

Cheers,

Ian

I didn't see any Kamala voter who told anyone Trump would be bad for the markets. It was all about abortion, that he's a rapist, new Hitler, doesn't respect the rule of law...

Turns out that was all red herring and now it's about the markets and economic crash.

Kudos to you if you predicted this, you must be smarter than all of us. I'm not being sarcastic btw.