In general, inflation is related to the number of dollars in circulation. The more dollars available to spend the less value each dollar has with respect to all currency available. When using a fiat currency (debt) there is built in inflation and the primary job of the Fed is to keep inflation low as it pertains to government policy. The Fed does this by adjusting interest rates.

Usually the Fed will look at consumer prices, employment, and a thousand other things related to an economic model to determine how to address the interest rates. The Gross Domestic Product (GDP) is a measure of how much money the country is making and is usually highly related to the need for printing more / less money - so the government can offset its deficit spending. The better the GDP, will generally mean employment rates are better, the country is making money, more taxes can be charged, and there will be a lower need to to print.

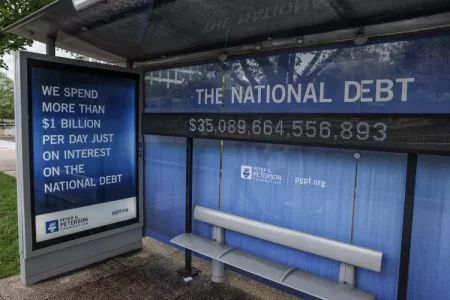

In the case of the stock market at present (dropping rapidly), this is seen by the Fed as a concern so they are likely to drop interest rates to overcome this problem by making money easier to acquire. The thing is, Trump wants the rates to drop and by using tariffs to drop the stock market, he will be able to refinance a large portion of the national debt at an extremely low interest rate (near zero). This will lower the pressure on the governments budget (because interest payments are a large portion of the federal budget). With the budget lower, it secures things like social security, Medicare, and other entitlement funds because there is less interest that has to be paid.

The tariffs will also increase manufacturing within the country because foreign countries will not have to pay a tariff if they manufacture inside the US. So foreign investment in the US is expected to rise, thereby increasing the number of jobs available, increasing GDP, and keeping supply elevated and prices lower. It’s really genius because most people haven’t seen tariffs as a plus for consumers but when it’s applied in the aggregate and foreign countries need US market share to make their investors / stockholders committed, they will pony-up the money. Of course there are risks but that is dependent on the entire strategy being orchestrated by the executive branch (which nobody fully knows).

I’m generalizing in my above comments. It’s much more complex than what I’m saying, but I’m not an economist. So, take what I’m saying as a simplification rather than hard facts.