philostam

Well-known member

- MBTI

- INTP

- Enneagram

- 6w5

I guess any currency whatsoever is based on a fiction. What exactly is it at the end of the day, but tokens assigned an artificial value? Like any currency, as long as sufficient people believe in bitcoin, it will hold or increase in value compared with other currencies, and if they stop believing in it then it will drop in value. It seems to me it's a law of nature as strong as the law of gravitation, I guess. The technology is really secondary to this, though it does have a strong secondary influence, because like gold, there is a restriction on the amount of bitcoin that can be generated. I guess a big risk with a crypto currency is if someone finds a way to hack the underlying system - by destroying it perhaps, or ramping it externally. Essentially, all that is necessary is to destroy confidence in it and its value will collapse, at least temporarily if not permanently.

I can understand @David Nelson 's ethical concerns. I'm very uncomfortable with currency dealing as a way of making money, except as a part of the fees necessary for swapping currency as part of the financing of the manufacture and trading of goods and services internationally. I'm much more laid back about private individuals spreading savings around a number of different currencies as a way of reducing risk to their value through crises and inflation. I can't see any problem ethically in putting some into bitcoin - ethically it's no more significant than investing in inflation-proofed government loan stocks, or simply holding cash accounts in dollars and euros as well as sterling (say). I can't see that adding a bitcoin account is any different than someone from the UK having some money stored in a dollar account.

I think the biggest problem is having a clear understanding of what it is and how it works - there seem to be plenty of sources of information about that, but I haven't really looked hard at it yet. I wouldn't put cash into something I don't understand. I think what gives me a lot of unease about it is that it's value against conventional currencies has gone up vastly more than they have depreciated through inflation, which stinks of bubble. The fact that its growth (in terms of bitcoin in circulation) is restricted automatically gives some reassurance that such growth in value is not all bubble, but it still makes me uneasy. I do wonder if some shady organisation is ramping it - but here I'm just giving more structure to my ignorance of how it works maybe?

Some valid points and concerns here. I'll try to tackle some, as my time permits.

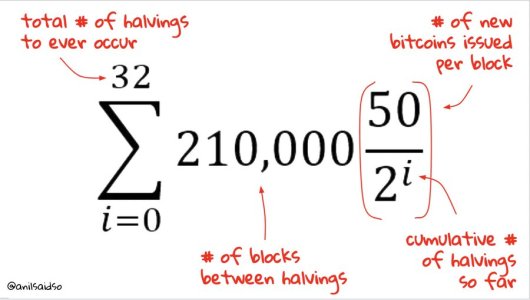

Safety: I won't pretend to be a technical/cryptographic/computer science expert, but Bitcoin is not a strictly "online" currency. Like gold, it has to be mined in the real world. The only way to corrupt the Bitcoin network is to create a so called 51% attack, i.e to sieze 51% of Bitcoin mining network around the world which is decentralized across many geographical regions and is capital intensive.

Ultimately, Bitcoin has been running without fault for 12 years and with each day it's not corrupted, it's case becomes stronger. Not only because of Lindy effect but also because the mining hash rate grows over time, so the system becomes more secure and difficult to solve. As far as I understand, Bitcoin uses SHA-256 hash function which is insanely difficult to solve. You have a 1:2^256 chance to create a new block on the blockchain. If you guess the correct number from 1 to 2^256, I will give you all my net worth.

Another element of safety is counter-party risk, and with Bitcoin you don't need to worry about that. You store it on your cold (meaning offline) wallet and you don't need to "trust" any other party. This makes it much more secure than a bank or an online broker or something like that. It's like having your money on an USB drive. But even if you lose the USB, you can still restore it with the 24 word seed key. So, all you need is to remember 24 random words.

The ESG crowd will say that Bitcoin mining consumes too much electricity and is destroying the planet, but in my opinion fiat currency does much more damage. If you wanna have a hard currency as opposed to fiat currency, it has to be capital intensive to create more of it. If you make it too easy to print more, people will ultimately give in and do it.

OK, that's it for now, maybe I will write some more later.

Last edited: