But that's something I do not completely get though, you can't keep on pushing inflation indefinitely. It does put more and more pressure on the economy, doesn't it? And we are already pushing far on that pressure lid.

As for taxes, Yes they are proposing to tax the super rich (Global Tax Agreement, etc.), but that doesn't mean this will be the end of all means for the general economy. For the past months -now speaking from a European perspective- Energy prices, Food and general Consumption prices (due to transportation fuel costs) have risen a

lot in comparison with the European economical growth, for a variety of reasons. Europe is handling these costs but these costs are be pushed further onto its member states (and their citizens). So in general the cost of living has pumped up this year for the average European citizens already, while the wages are currently already lagging behind with this price increase. Which in turn lowers buying power of the European citizens and lowers average consumption. I doubt that the European governments can handle this situation without proposing tax increases in certain areas?

https://ec.europa.eu/taxation_customs/taxation-1/economic-analysis-taxation/data-taxation_en

https://ec.europa.eu/info/sites/default/files/economy-finance/ip169_en.pdf

1.5.3. Inflationdevelopments

After decreasing on average by 0.3% in the last quarter of 2020, euro area prices started increasing again last year, gathering strong momentum in the last quarter of 2021. In December, HICP inflation in the euro area reached 5%, the highest reading on record. It averaged 4.6% in the fourth quarter, almost one percentage point higher than expected in autumn, and 2.6% in 2021 as a whole. In the EU, the inflation rate was 4.9% in the final quarter of 2021 and 2.9% for the year. Dispersion among the non-euro area Member States widened in the fourth quarter, with inflation ranging from 3.5% in Denmark to 7.3% in Poland. Dispersion was however exceptionally wide also in the euro area, mainly on account of the differential impact of energy inflation across EU countries.

(8) European Central Bank, Statistical Data Warehouse

Energy inflation was indeed the main driver of headline inflation in the euro area and beyond, though the December reading (25.9% in the euro area) came in a notch lower than in November, amidst fading base effects (see Box 1.2). Food inflation is also driving headline inflation up, with December registering a major increase in unprocessed food inflation (4.7%), on account of both a strong base effect from last year and solid month-on-month growth (1.5%). Averaged over the fourth quarter, unprocessed food inflation rose to 2.6% in the euro area. Higher input costs, in particular for fertilisers, are fuelling pressures on food prices.

And I agree with you that it is within one's own interest to buy hard assets rather than invest in assets that can be heavily regulated (I would doubt that they would be able to just seize assets).

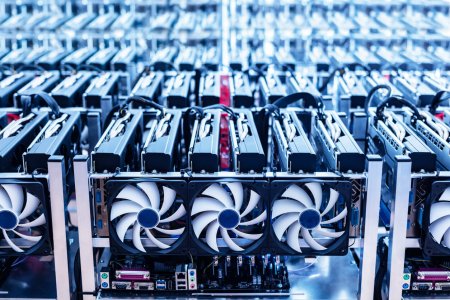

Bitcoin however, even though I do invest in crypto myself, is something I'd say to be wary of in the future. The governments still need to take the step to implement digital assets within their own controlled environment.

China has the Digital Yuan (e-CNY), the US government (Biden's executive order) proposed to invest into the research of a digital e-Dollar in 2022. India's digital Rupee will have a planned release in 2023. And Europe is, albeit slowly, also researching the possibility for the digital Euro. I'm not sure on Russia, perhaps the will implement bitcoin in their economic architecture, but with the whole current situation I don't think that's something that will be implemented immediately.

So Bitcoin, and all the digital crypto will either have to sidestep its position on the current market or will have to adhere to international taxation laws in accordance to agreements of the centralised (ironically) instances regulating the digital currency. So I wouldn't count bitcoin as a safe asset in the long term, without a clear vision on the outcome of digital currency. Even though more and more people are putting their earned money into it.